Hybrid truck-robot-ambulance-tank epitomizes carmakers' quest to stay relevant

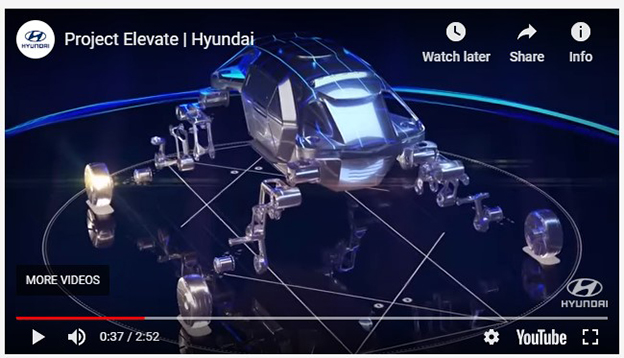

Imagine a car that’s capable of walking. Now picture it with long, articulating robotic legs and tubeless tires.

Hyundai unveiled Elevate at the CES technology show in Las Vegas this week. The 1/8 scale concept is designed to go where traditional vehicles have been rendered useless.

The archetype is fitting. Car companies need to remake tired business models.

Elevate was inspired by real-world problems. Current rescue vehicles are often unable to traverse the debris created by tsunamis and earthquakes. As a result, first responders have to make their way to victims on foot, carrying heavy equipment through flood zones and over crumbled concrete.

In stowed drive mode, Elevate’s legs fold up and the vehicle operates as a standard four-wheel-drive explorer. When the legs unfold, Hyundai product managers claim the vehicle is capable of climbing walls, or stepping over a five-foot gap. The official corporate video depicts a revolution in locomotion.

Meet Elevate, Hyundai’s car that can walk. (Click here to see it in action on YouTube.) But can it rescue not just disaster victims, but also the car industry itself?

Getting there did not come easily. It was also necessary.

Hyundai has been moving fast to stay abreast of the trends started in Silicon Valley. Young, nimble companies are building a future of mobility that’s less reliant on vehicle ownership.

Ride hailing, sharing and subscription businesses turn the traditional automobile business model on its head. As more people begin to view mobility as a service, and price-per-mile rates plummet, the need to own a car starts to evaporate.

Related post: Why carmakers are in a death spiral

The daddy longlegs Elevate concept vehicle is the product of CRADLE. That’s Hyundai’s center for robotic-augmented design in living experiences.

To poach engineering talent, the innovation center opened offices in Silicon Valley in 2017 and Tel Aviv in 2018. Hyundai is planning additional outposts for Berlin and Beijing.

For now, the company is focusing on collaborative efforts to speed up the commercialization of autonomous vehicles. However, managers see CRADLE as a flashpoint for artificial intelligence, smart energy, smart cities, cybersecurity and robotics.

Related post: New software helps hotel guests rest easy amid cybersecurity threats

Elevate ticks most of these boxes. The vehicle is fully electric, with next-generation battery packs lining the floor of an interchangeable cabin. Artificial intelligence allows its robotic legs to unfurl and fold at will for both active and passive suspension.

The vibe between software and the articulated hips, knees and ankles allows Elevate to effortlessly switch from driving to two forms of walking.

- In mammalian mode, the vehicle has the agile gait of a deer.

- Reptilian mode blesses Elevate with the sure-footed grip of a leaf-tailed gecko.

Hyundai’s visionary new vehicle is no more than a concept at this stage. However, its development shows that traditional car companies are preparing for rough terrain. Product managers are exploring new categories ahead of mass commoditization. They are experimenting with high-margin specialty vehicles with advanced robotic systems and electric propulsion.

And all these experiments have something in common — they need power systems that can fit on tiny chips.

As cars and trucks move to electric propulsion and more motorized parts, every efficiency is a blessing. And Monolithic Power Systems (MPWR) designs the integrated circuits (ICs) to make the power systems more efficient.

Modern cars already have an average of $350 worth of semiconductor content. Consumers take for granted that newer vehicles have modern infotainment systems, safer lighting, advanced driver assistance systems and smart electronic devices. However, everything from USB charging and electric mirrors, to HVAC and LED light systems, use sophisticated ICs.

These circuits will multiply as the next generation of self-driving cars arrive.

eMotion is Monolithic Power’s gearless IC. It is 30% more power-efficient than traditional electric motor setups. It creates less heat while offering more torque.

It’s also less expensive. Ultimately, those savings mean better profits at value-added resellers and OEMs.

The company is currently working with every major auto parts supplier in the world. Through Delphi, Bosch, Panasonic Automotive, Magna and Mitsubishi Electric, the company reaches end customers such as Ford, Nissan, BMW, Mercedes, GM, Volvo, Toyota and Volkswagen.

And these partnerships are paying off …

The company reported revenues of $160 million for the fiscal first quarter, an increase of 24% over a year ago, with gross margins of 55.6%. The company has been growing sales at a steady high teens clip for the past five years. And net income grew 23.7% last year, to $65.2 million.

Monolithic shares are down from a high near $150 in September. The market capitalization is only $5.1 billion. The stock trades at 26.5x forward earnings. That is cheap by historic standards.

As car companies change business models, Monolithic is in the right place, with the right product. You can buy the stock into the current weakness near $125. For full disclosure, this is an open position in my Power Elite newsletter. To get timely buy and sell signals on this and my other recommendations, including a brand-new buy in an energy technology company with terrific cash flow, click here.

Best wishes,

Jon D. Markman