Major automakers are discovering the benefits of electric cars. And it is a really big deal.

This week, Porsche announced that its “Mission E” electric concept led to a corporate epiphany. The German maker of luxurious, fast cars is now committing to electrify 50% of its production by 2023. Given that its 2016 output was 230,000 units, this would be no small feat.

This also accelerates two important trends: the longer-term decline of fossil fuel prices … and the rise of digitization.

Let me explain.

Energy prices are not governed so much by overall demand, as they are by margin. Worldwide demand for oil is about 85 million barrels per day. Supply is roughly equivalent. When there is imbalance, even a relatively minor one, prices fluctuate wildly.

From June 2014 through March 2015, worldwide oil markets were roiled by chronic overproduction. A 2 million barrel-per-day (bpd) glut developed. West Texas Intermediate crude oil prices plummeted from $107.65 to $42.11.

Last year, Michael Liebreich and Angus McCrone, writing for Bloomberg New Energy Finance, predicted electric vehicles (EVs) will reach price parity with internal combustion vehicles by 2022. They concluded this could create a 2 million bpd glut as early as 2023.

The math is easy. The implication, for energy investors, is daunting. Even minor EV adoption will create a systemic imbalance in worldwide energy markets.

You can blame the Tesla Model S. The refined electric sedan was the first environmentally friendly vehicle without compromises. It was greener than a Prius and faster than a Lamborghini.

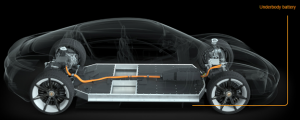

The engineering would not have been possible 20 years ago. The Model S is the product of the exponential progression of information technology. It pushes data analytics, artificial intelligence, the Internet of Things and robotics to their current limits.

A Tesla can be summoned from sleep in the garage with just a few taps on the smartphone application. Over-the-air software updates remotely fix problems that require recalls for other manufacturers.

In the largely analog world of cars, a Tesla is a fully digital, consumer electronic device. And its peers have taken note.

Reduced maintenance costs, better safety and reliability, and platform superiority for autonomy and shared mobility cannot be ignored. Even in a world where fossil fuel prices are likely to remain low, it’s difficult to justify longer-term investment in internal combustion.

That’s why Porsche is making the jump. It’s why Volkswagen has committed to electrify as many as 2.5 million vehicles by 2025. It’s also why Ford (F) committed $4.5 billion to electric cars. It even changed the location of its Focus plant from Mexico to China to get closer to EV components. And I could go down the list of traditional car companies clamoring to get aboard the EV bandwagon.

The change is happening. And it is likely to be swift.

Liebreich, given his roots in Fluid Dynamics, likens the process to material science. He reasons that change for complex systems tends not to be linear. It’s more like “flipping from one state to another,” he wrote in 2015.

Most analysts assumed smartphones would lead to incremental societal changes. What transpired was tectonic. Media, information, commerce and even small stuff like maps all became digital. They were transformed into bits of code for use on smartphones.

EVs will do the same for infrastructure. Power grids, roads, buildings and shopping malls will all mutate to accommodate the migration to electrification. In the process, the entire physical world will become networked. It will routinely undergo data analytics and software updates. It will become digitized.

It’s a big change. Tectonic, really.

It’s the kind of thing few pundits talk about. They think it’s too far off in the future. Something you don’t have to worry about, let alone plan for.

And mark my words, they will not take advantage. They’re the same people who railed against Amazon (AMZN) when it was reinventing enterprise IT infrastructure with the public cloud. Now they are missing the most important change in our lifetime. The digitization of the physical world.

Finding investment opportunities in this mega-trend is a commitment I have made to my members.

I believe this era, what I call the New Gilded Age, is a once-in-a-lifetime opportunity. New inventions and business models are being developed right now that will shape our age. Astute investors will earn terrific fortunes.

Don’t let anyone tell you it’s too far away. These things happen quickly. The time to invest is now.

Best wishes,

Jon Markman